SPOSORED CONTENT

Getting to the Finish Line on Big Client Projects

By Chase Home Lending

Maybe the flooring in the kitchen is scratched, or the vanity cabinet in the bathroom is outdated. But often the biggest issue keeping you from making progress on your clients’ home improvement projects is money. Clients often underestimate their projects, which actually cost five times more than they expected, on average1, once they’ve been accurately estimated by a professional. That’s why it’s important to make financing suggestions during your estimation phase.

A home equity line of credit (HELOC) is often the way to go.

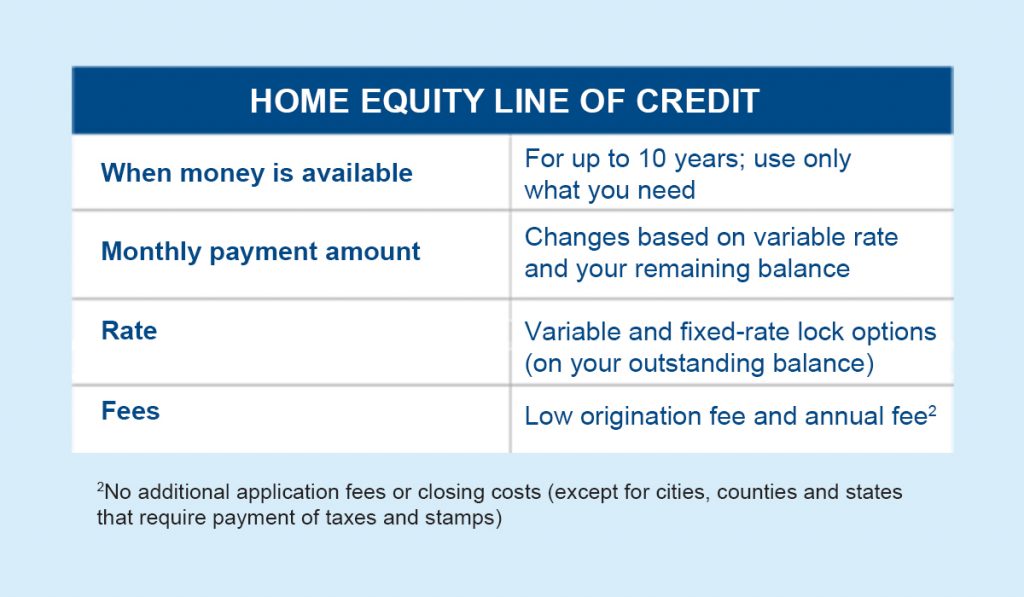

Instead of relying on a single lump sum of cash, your clients could get access to a larger amount for up to 10 years. They only pay back what they use, making it an effective choice for projects that are hard to estimate. It also gives them the ability to start other projects with you after the current one ends. So, when they see what a great job you did on their bathroom, for example, the funding may already be there to start thinking about the kitchen.

But not all HELOCs are created equal, the bank makes the difference. Chase, for instance, offers rate lock options (depending on your client’s balance) which means that they’ll be able to lock in a fixed rate for a portion of their balance, so they don’t have to worry about a raising rate environment. There are also low origination and annual fees with a Chase HELOC.

Maximize your time with the clients who have the funding.

Nearly half of all U.S. households — 60 million people — are already Chase customers. So, if your customers already have a relationship with Chase, it’s easier for them to get started on a HELOC — which in turn makes it easier for you to get work done. Plus, Chase offers rate and home improvement discounts that could save your clients money and options where their interest may be tax-deductible. That’s great news for you, too, because when your clients can save on their home equity line of credit rate, they may have more to spend on projects with you.

A chat with Chase can help you find out more.

Chase will be in attendance at the NKBA Chapter Officer training at KBIS in February, but if you want to talk to someone sooner about the benefits of recommending Chase to your clients, contact Kirt Donatello at 214- 205-1441 kirt.a.donatello@chase.com or visit chase.com/HomeEquityPro. Please visit us at Booth SL 3476 during KBIS.

1 Hunter, Brad (2018). Home Advisor True Cost Report.Retrieved from https://homeadvisor.com/r/true-cost-report/#.WZ2nff6ovKJ