Despite near historic low rates, trouble still looms for some homeowners.

By Manuel Gutierrez, Consulting Economist to NKBA

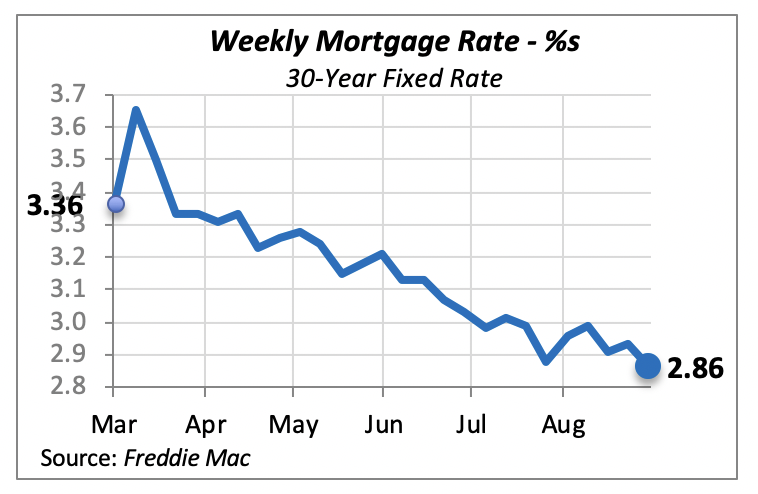

Driven in part by the ongoing policies of the Federal Reserve Bank, the 30-year fixed mortgage rate fell by seven basis points (-0.07%) to 2.86% during the week ended Sept. 10. Since the beginning of the year, the rate has dropped almost nine-tenths of a percent.

The Fed’s stated policy is to balance its goal of maintaining low inflation while attempting to boost employment. In the latest pronouncement by Fed Chairman Jerome Powell, the tilt was more toward the latter. The new policy is to allow slightly higher inflation, exceeding the previous 2% limit, as long as it leads to an improvement in employment.

One of the Fed’s tools to achieve this goal is through the maneuvering of interest rates. Although there is no consensus among economists on a correlation between lower interest rates and an improvement in employment, most believe that lower rates do help.

For the kitchen and bath industry, it is a given that lower rates make it easier for consumers to borrow funds to purchase a new home or to finance the remodeling of an existing one. Although the correlation between new housing construction/home sales and interest rates isn’t absolute, historically, lower rates have been accompanied by higher levels of housing activity.

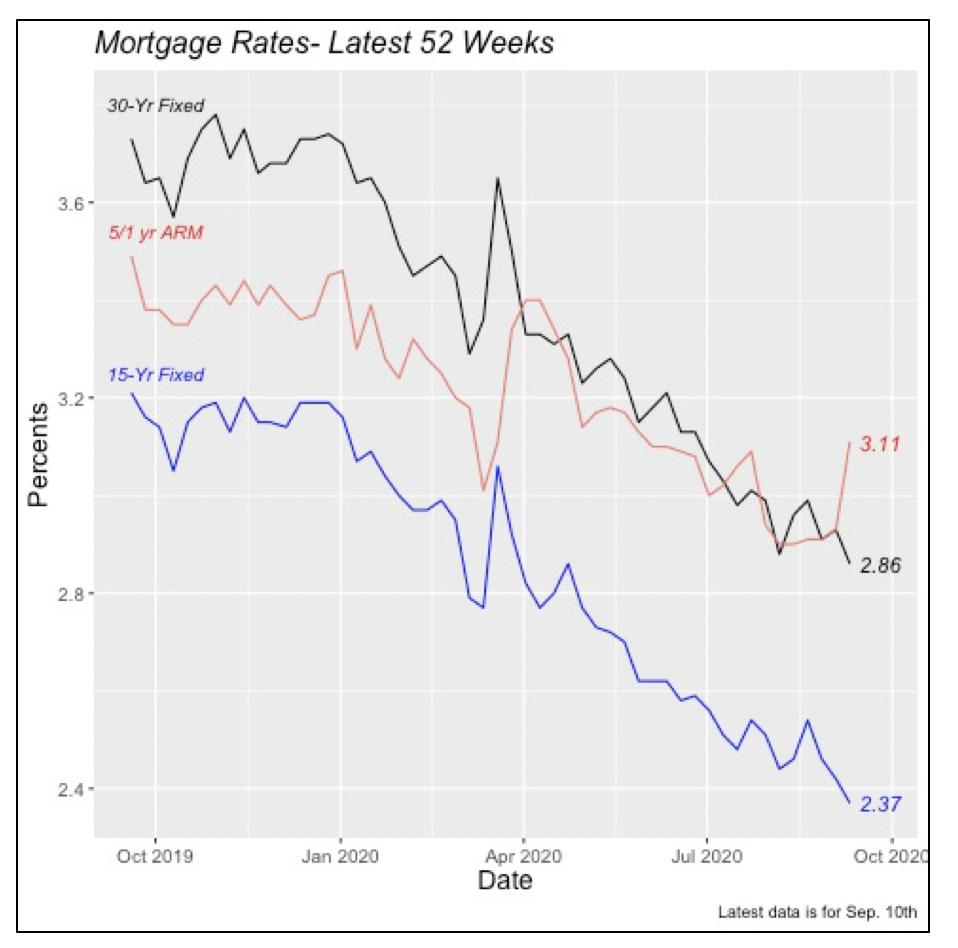

Along with a decline in interest rates for a standard 30-year fixed loan, the rates on other types of mortgages have trended downward as well, as the chart below illustrates.

The rates on shorter-term mortgages, such as 15-year loans, are lower than those for the 30-year. Over the last five years, the average weekly rate on 15-year mortgages has been 0.6% below the 30-year. Yet, 9 in 10 consumers continue to prefer 30-year loans when borrowing funds to buy a home. The primary reason consumers prefer longer-term loans are lower monthly costs, despite being more expensive in the long run. Monthly payments on a 30-year loan average about 30% lower than those for a 15-year. This allows consumers to either purchase a larger or more expensive home, or be sure monthly costs are within their budget.

However, lower mortgage rates do not help the millions of homeowners who currently have a mortgage on their home, but because of the current economic situation, cannot meet the monthly payments. Their only relief is a temporary forbearance of their monthly payments that can buy them a few months. According to the latest estimate from the Mortgage Bankers Association, there are currently 3.6 million homeowners with a mortgage under forbearance.

Unless their economic situation improves, many of these homeowners may find themselves facing foreclosure. As of June, the latest month for which data is available, 7.1% of home mortgages are in some stage of delinquency, which is defined as 30 days or more past-due. This is a slight improvement over the previous month, when 7.3% of mortgages were at risk.